The Portfolio Optimization Machine

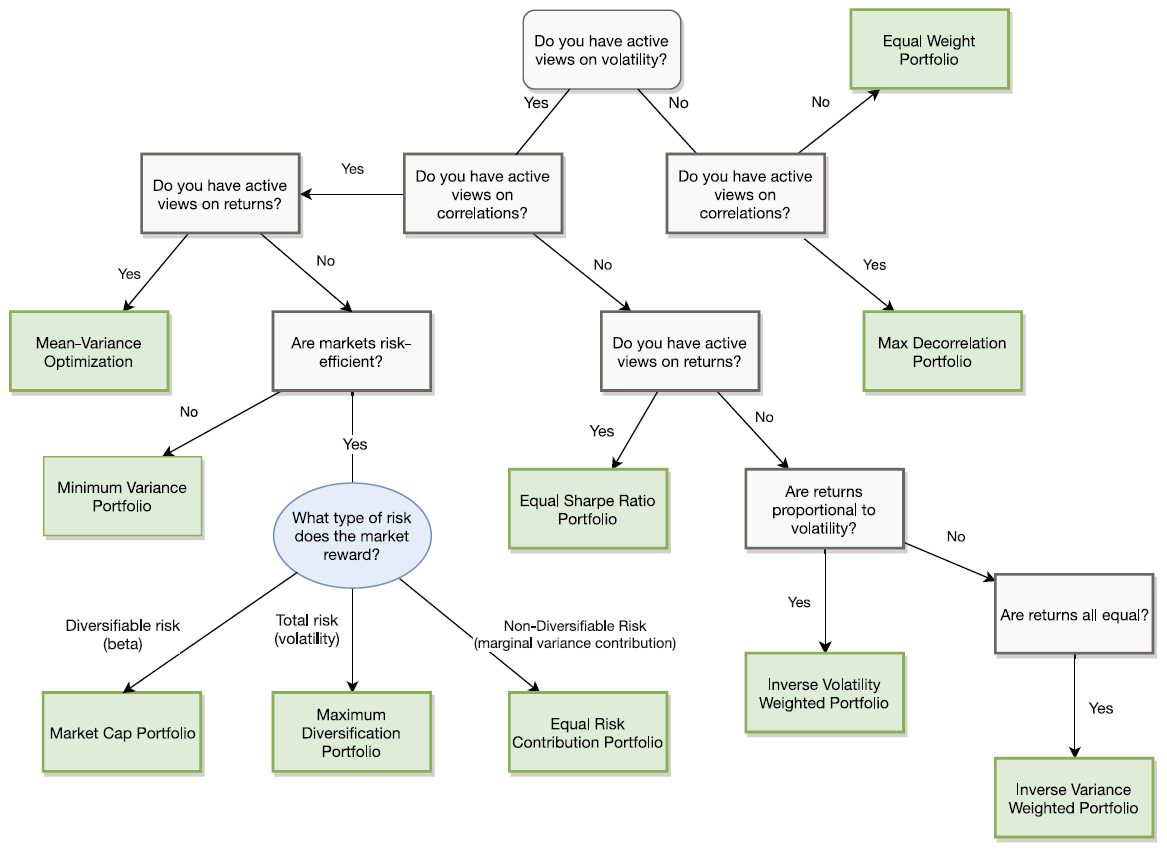

In 2018, guys at ReSolve Asset Management published the paper Portfolio Optimization: A General Framework for Portfolio Choice in which they describe

a stepwise framework for investors to choose the most optimal way to form portfolios, as a direct expression of their beliefs and assumptions.

In particular, they introduce the following decision tree:

Since I discovered this decision tree, it has been one of my objectives to make the mentioned portfolio optimization algorithms available to as many people as possible:

- Mean-Variance Optimization

- Minimum Variance Portfolio

- Market Cap Portfolio

- Maximum Diversification Portfolio

- Equal Risk Contribution Portfolio

- Equal Sharpe Ratio Portfolio (that I understood as Equal Sharpe Ratio Contribution Portfolio)

- Inverse Volatility Weighted Portfolio

- Equal Weight Portfolio

- Max Decorrelation Portfolio

- Inverse Variance Weighted Portfolio

Entering 2021, I am proud to announce that this is now done: all the above portfolio optimization algorithms are available as endpoints of Portfolio Optimizer!

The documentation of these APIs is available there.

Happy new year 2021.