A Word Of Introduction

A good portfolio is more than a long list of good stocks and bonds. It is a balanced whole, providing the investor with protections and opportunities with respect to a wide range of contingencies.

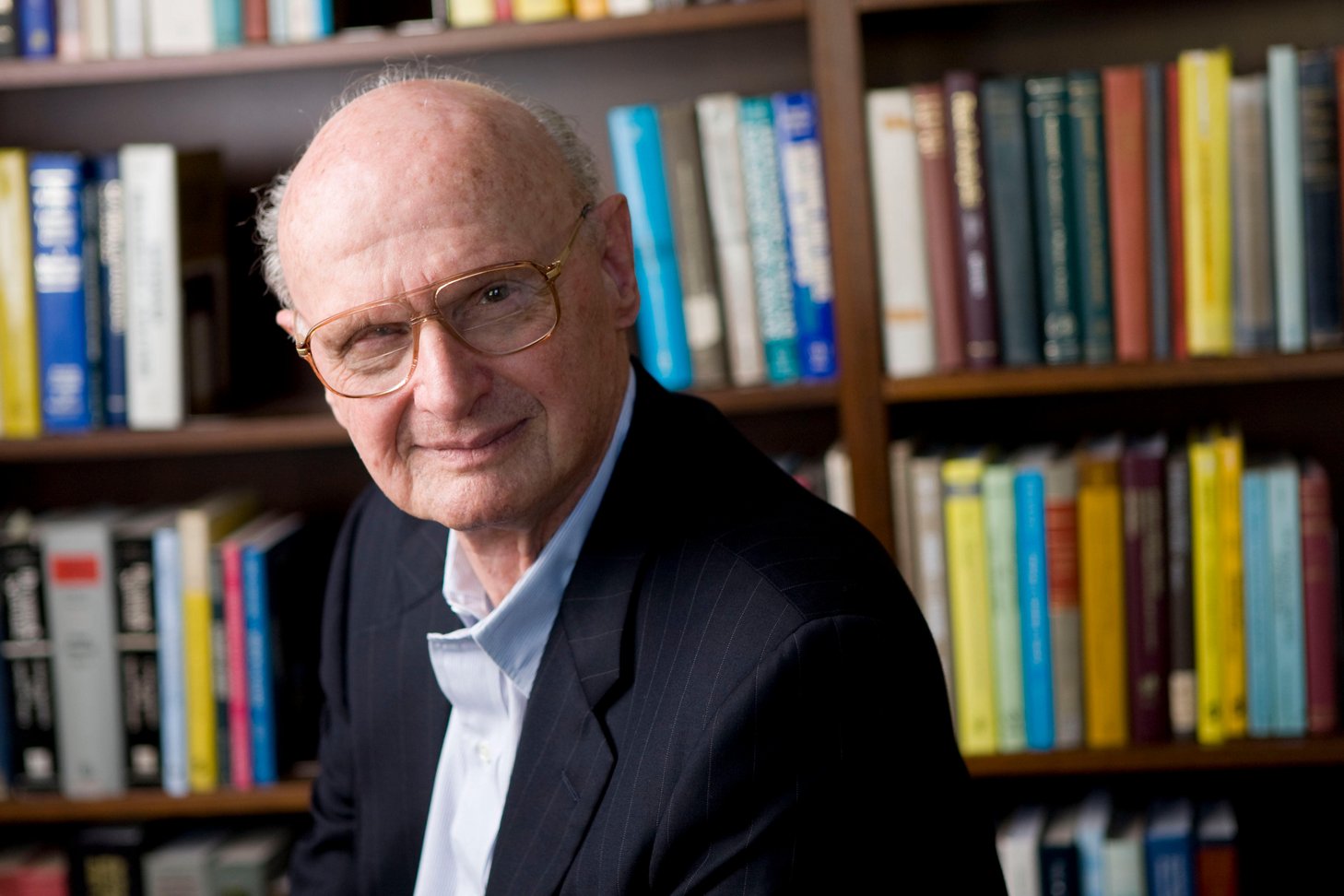

Harry Markowitz, Nobel Laureate, pioneer of the modern portfolio theory

Why Portfolio Optimizer

Creating a financial portfolio as a balanced whole - in the modern portfolio theory sense - requires complex mathematical algorithms.

Portfolio Optimizer exposes these algorithms as an easy to use Web API, thus democratizing the access to the Nobel Prize-winning science of portfolio optimization.

Features

Free, no registration required

Portfolio Optimizer is a 100% free to use Web API, with no need to provide contact information.

No coding skills required

As a Web API, Portfolio Optimizer is usable from web pages, from Microsoft Excel, from Google Sheets…

No PhD in mathematics required

Portfolio Optimizer hides the complexity of portfolio optimization algorithms behind well-designed Web API endpoints.

Get Started

Below is the Portfolio Optimizer Web API call to compute the long-only minimum variance portfolio of 2 assets with covariance matrix $\begin{bmatrix} 0.0025 & 0.0005 \newline 0.0005 & 0.01 \end{bmatrix}$:

fetch('https://api.portfoliooptimizer.io/v1/portfolio/optimization/minimum-variance',

{ method: 'POST',

headers: { 'Content-Type': 'application/json' },

body: JSON.stringify({ assets: 2,

assetsCovarianceMatrix: [[0.0025, 0.0005],

[0.0005, 0.0100]]

})

})

{}![]() Congratulations for your first usage of Portfolio Optimizer!

Congratulations for your first usage of Portfolio Optimizer! ![]()

What’s Next

Stay Updated

Subscribe to Portfolio Optimizer’s news feed to receive the latest blog posts by email.